Tax and Accounting Tips

West Salem Tax & Business Boutique Blog - Salem, OR

Changing the Way We Do Business… Are you Ready?

Over the last couple years, we have seen some major shifts in the way we do business. As our world has changed, we too have rapidly transformed as business owners and employees, and have learned to adapt accordingly. New businesses have sprung up in record breaking numbers. In 2022 a total of 5.07 million business applications, a 42% increase from pre-pandemic levels. We have seen it here in West Salem too, as we have helped businesses start up, we have helped people shift from employee to business owner. The businesses that have survived thru our ever-evolving world have shifted also. Some of the trends that are happening to the way we do business…

• Sustainable, resilient operations: Businesses have cut costs, and become more resilient.

• The Technological Revolution: Remote employees are essential to filling positions. Websites and social media, are practically mandatory, if you want to compete.

• The shifting talent pool and changing employee experience: The workforce has included more younger people, more gig workers, and more remote workers.

• Businesses are more agile: Business leaders recognize the necessity to reorganize teams to respond to change more quickly and be more accommodating to it’s customers and employees, particularly the proliferation of freelance and remote workers. Being adaptive to supply chain shortages have been key to survival.

• Authenticity: Consumers have exercised their power to purchase, and are seeking a more meaningful connection with brands. Authenticity helps to foster human connections – because, as humans, we like to see brands (and business leaders) display important human qualities like honesty, reliability, empathy, compassion, and humility.

• Purposeful business: Similar to authenticity, the trend for organizations to exists to serve a meaningful purpose– and not just serve up profits to shareholders. Importantly, a strong purpose has the promise of transformation or striving for something better– be it a better world, a better way to do something, or whatever is important to your organization.

• Cooperation and integration: As more businesses have started and anything can be achieved by outsourcing. The global business world has never been so integrated. It has become increasingly more difficult to succeed without close partnerships with other organizations as well as our customers.

• New forms of funding: The ways in which companies and individuals can generate capital is also changing. New platforms and mechanisms have sprung up to connect businesses with investors and donors; driven by the decentralized finance movement, in which financial services like borrowing and trading take place in a peer-to- peer network, via crowdfunding and blockchain networks.

• The Robots are here: Automation, artificial intelligence, and a worldwide digital communications network is reshaping our world. With increasingly capable robots and artificial intelligence systems that have replaced work that were previously done by humans; economists agree that some jobs have recently disappeared forever. Although more inexpensive goods, less tedious work, and previously unimaginable levels of personalization are just some of the ways our lives are likely to improve through the sheer power of technology. Millions of jobs in America have been lost, never to return due to automation and the robots are responsible for a larger chunk of US GDP each year.

• It is estimated that Robots could displace 20 million manufacturing jobs by 2030.

• The number of operational industrial robot jobs has increased by 14% annually, since 2016.

• 57% of employers say that the main goal of automation is the augmentation of worker performance and productivity.

• It is estimated that automation can accelerate the productivity of the global economy by 1.4% of global GDP annually.

• Artificial intelligence alone is expected to have a $15.7 trillion economic impact by 2030.

• Currently 71% of total task-hours are currently completed by humans, and 29% that are done by machines.

• It is predicted in four years 58% will be completed by humans and 42% by machines.

As we enter an era of great challenges and uncertainty, especially when it comes to employment. The age of robotics and artificial intelligence could bring a catastrophic crisis due to automation job loss fallout, but it also presents an incredible opportunity to create a better life for everyone. The worker of the future will increasingly be required to have knowledge in areas like programming and design as our place in the workforce moves from manual labor into positions that require more critical thinking and planning.

Ready or not, the future is here, and the changes are happening

more rapidly. We as workers, and business owners must be able to pivot and not be left behind. Realizing too, that with change there is also new opportunities. Whether we start up that business we’ve been dreaming about, tightening up the belt of the business we have, and becoming more accommodating to our customers and our employees, or getting the education we need to better prepare for the way we do business. What can you do to prepare?

Want to keep more money this tax season?

By Wilma L. Eichler

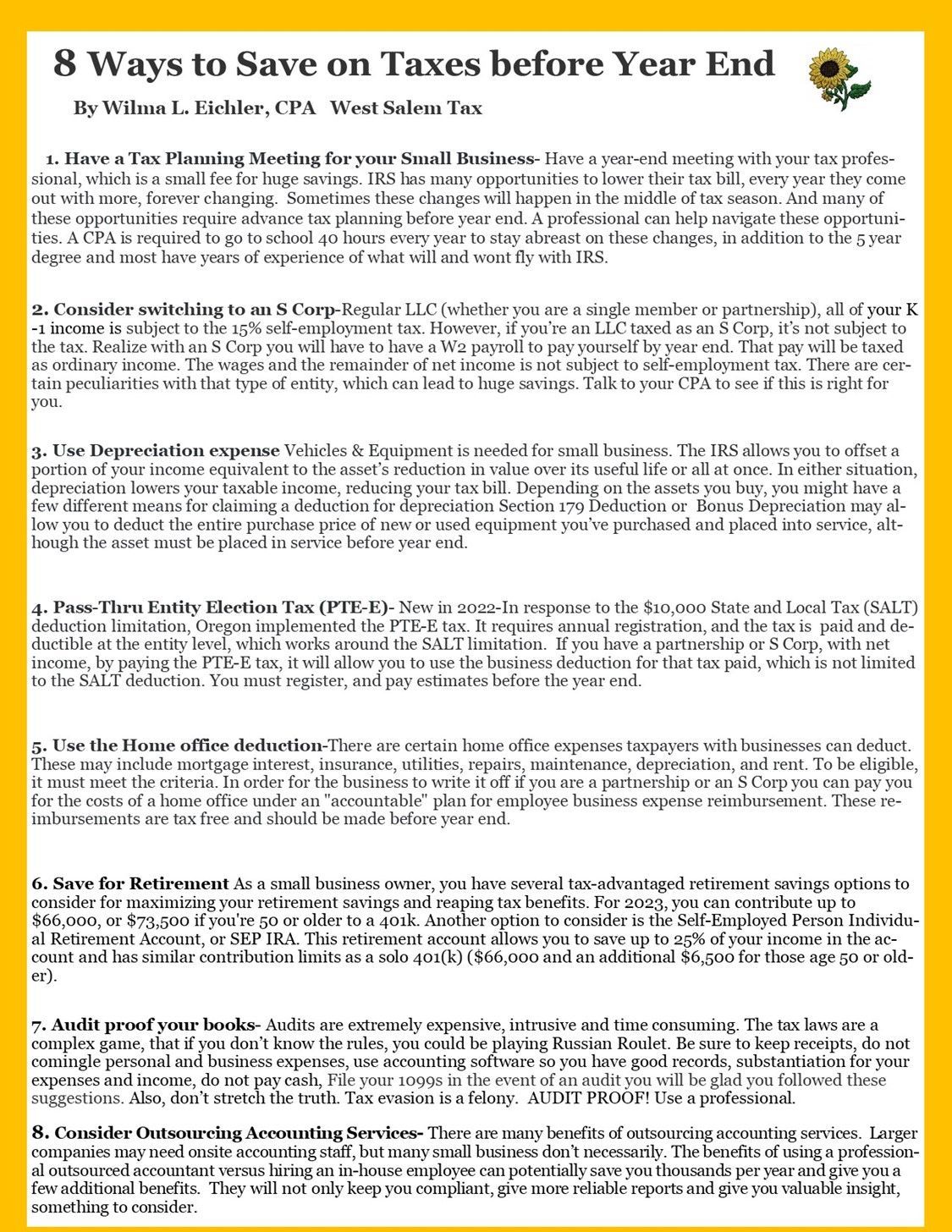

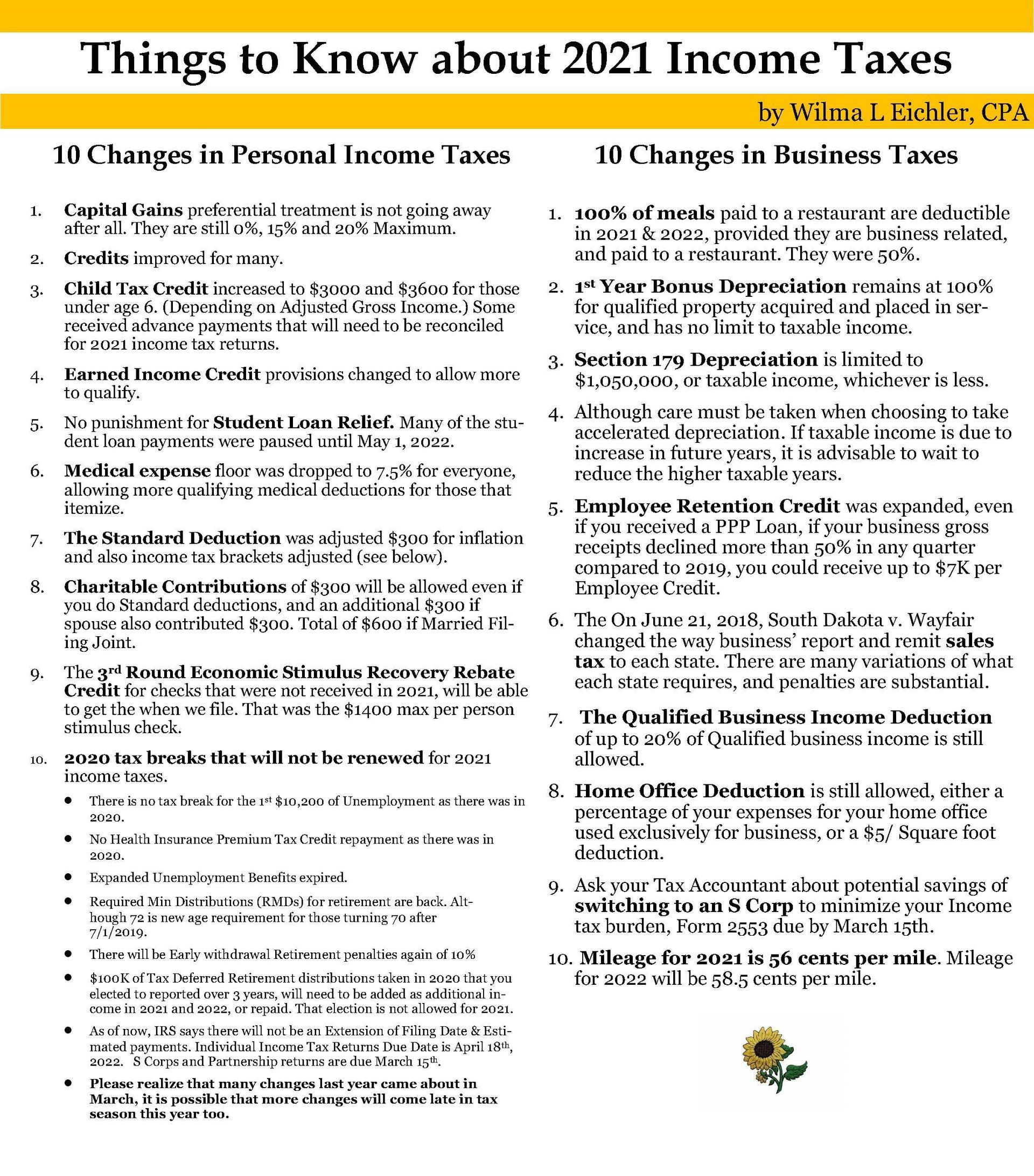

These strategies can help minimize taxes and help us keep more of what we work so hard to make. Planning for tax season can help. The federal filing deadline is April 18, 2022 for personal taxes; S Corps and Partnerships is March 15th; or you can file for an extension, to avoid hefty fees. It is crucial to keep tabs on changes to your situation, and to tax rules and laws that apply. Ask a tax professional for guidance, CPAs are required to go to school 40 hours every year to keep abreast of these changes. These are just a few planning strategies that can shelter income or cut your tax bill and help keep the IRS’ hands off your money, and more in your pocket.

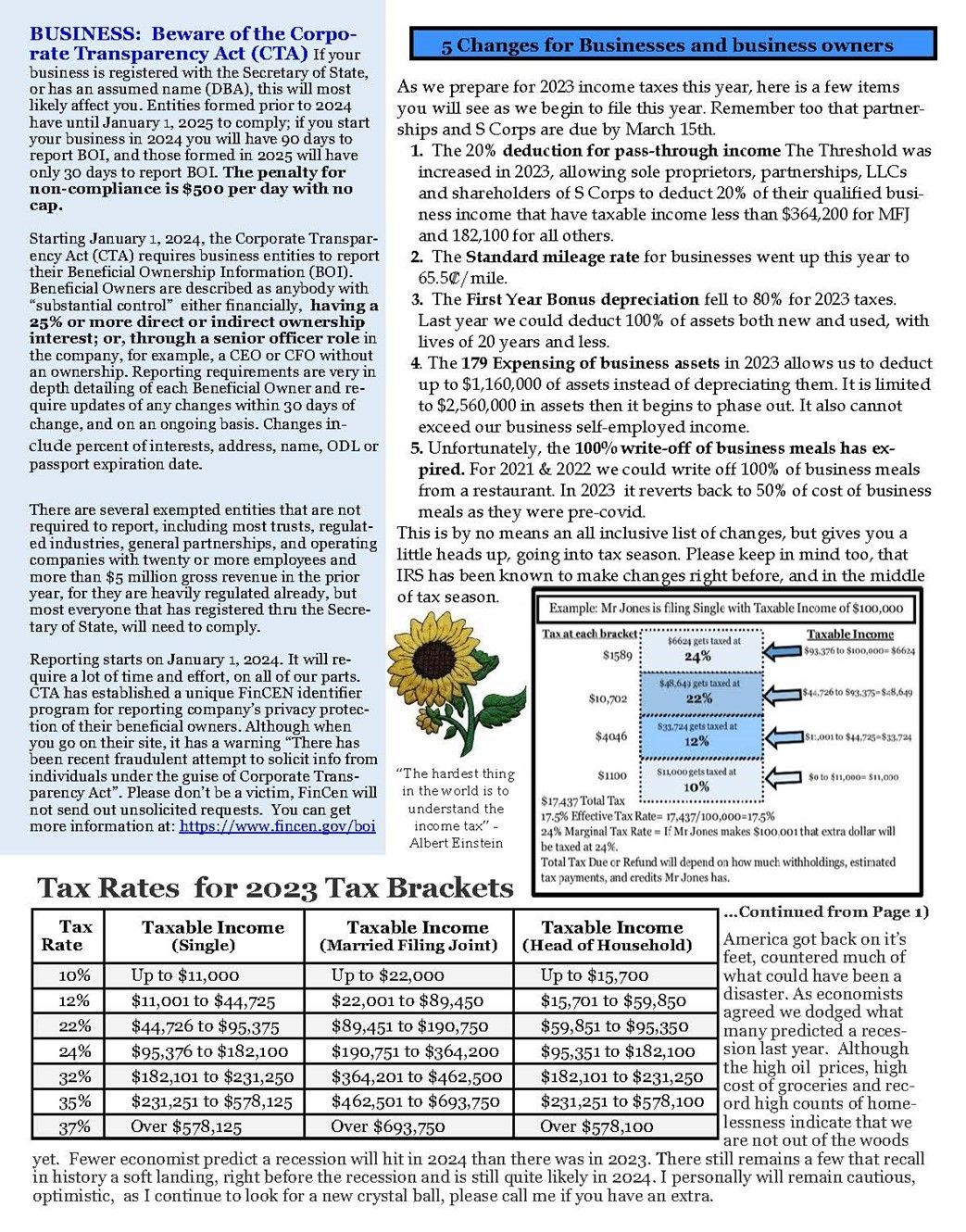

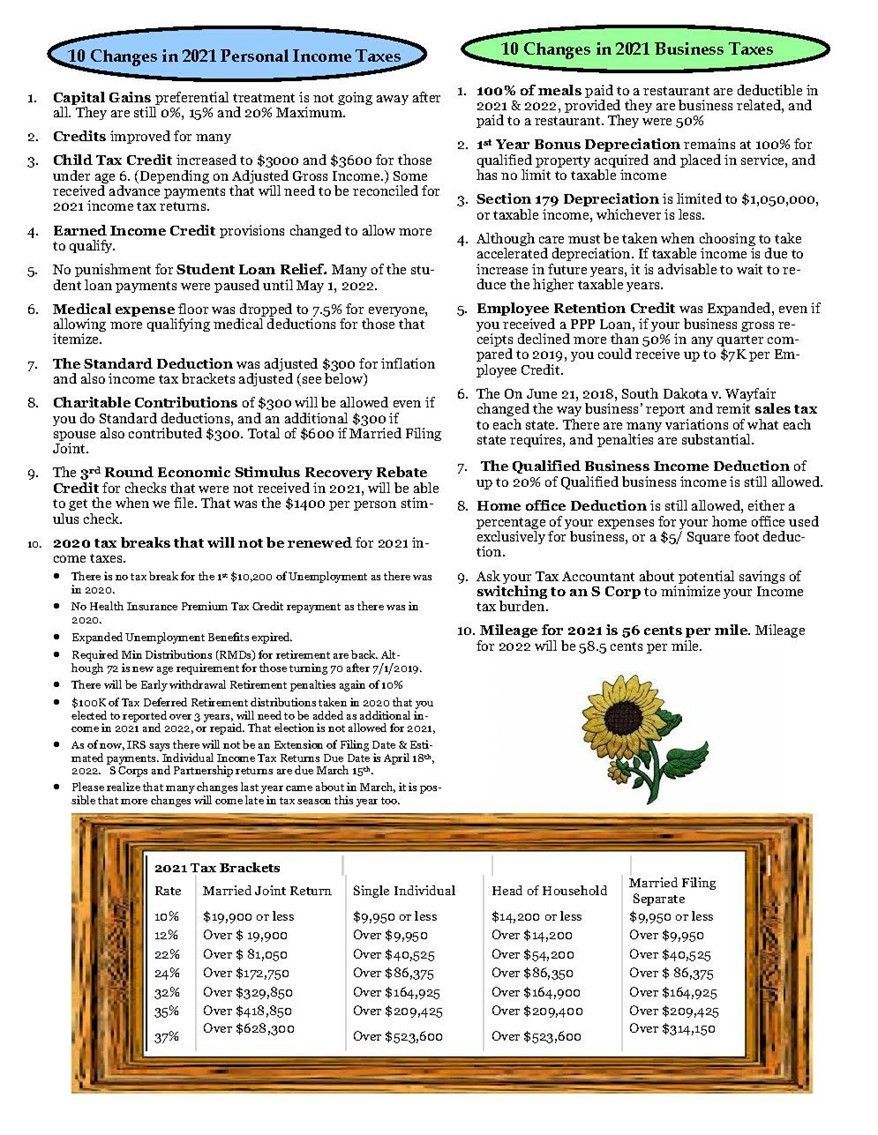

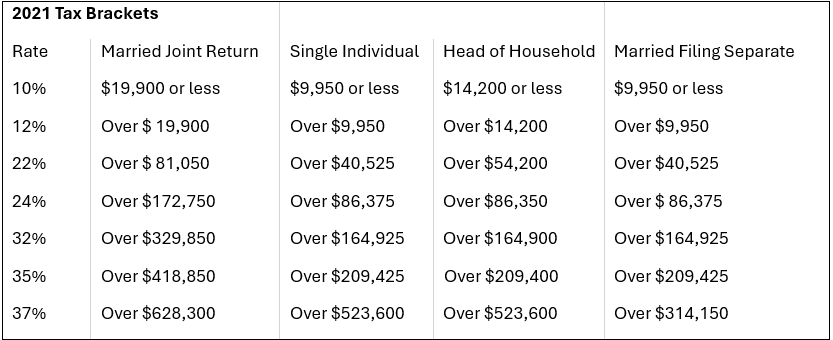

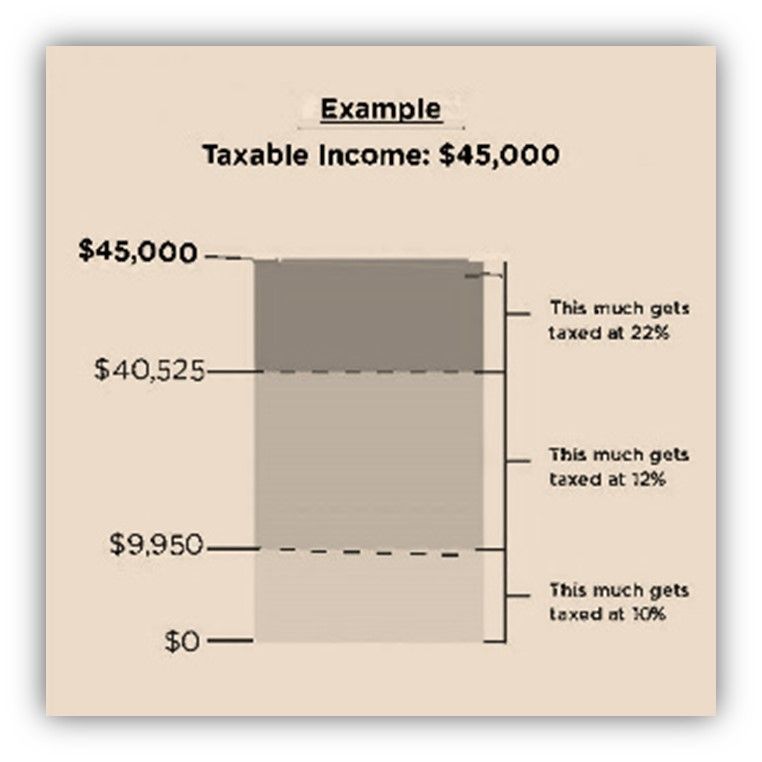

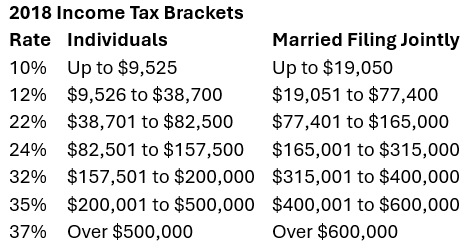

Tax planning starts with understanding your tax bracket. We have a progressive tax system. That means people with higher taxable incomes are subject to higher tax rates, while people with lower taxable incomes are subject to lower tax rates. There are seven federal income tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

This is not taxed on gross income, but rather your taxable income. The formula to arrive at taxable income and then to figure out what you will owe, or get back goes like this...

• Gross income [minus] adjustments [minus] either standard deduction or itemized deductions= taxable income [multiply by] tax rate = tax [minus] nonrefundable credits [plus] additional tax = total tax [minus] payments [minus] refundable credits= refund or tax you owe.

• You don’t just multiply your tax bracket by your taxable income. Instead, the government divides your taxable income into chunks and then taxes each chunk at the corresponding rate. Here is what it would look like if you were single and made $45,000.

• Taking the standard deduction vs. itemizing- Although the Tax Cuts and Jobs Act of 2017, increased the standard deduction and family tax credits, eliminating personal exemptions and making it less beneficial to itemize deductions. However, don’t assume the standard deduction is best. It should be calculated both ways, to ensure you are not leaving money on the table.

• The difference between tax deductions and tax credits: Tax deductions are specific expenses you’ve incurred that you can subtract from your taxable income, which reduces how much of your income is subject to taxes. Tax credits are even better, they give you a dollar-for-dollar reduction in your tax bill. A tax credit valued at $1,000, for instance, lowers your tax bill by $1,000

• Be aware of popular tax deductions and credits, listed here are few than can make a huge difference: Adoption credit, American Opportunity Credit, Child & Dependent Care Credit, Child Tax Credit, Residential Energy Tax Credit, and Earned Income Tax Credit.

Employees make sure you are taking advantage of all the benefits your employer is offering

1. Tweak your W-4. Review your paycheck withholdings. You decide if you want more refund at the end of the year, or if you want a little bigger paycheck during the year, it is up to you! You can change your W4 at any time, like Christmas, when you need more cash. You control how much is being withheld.

2. Put money in a 401(k) or an IRA. Or you can increase the amount of your contributions. Especially if your employer offers a match, this is an additional amount going towards your retirement. The IRS doesn’t tax what you divert directly from your paycheck into a 401K. There are two major types of individual retirement accounts: Roth IRAs and traditional IRAs and you will have until April 18th to contribute for 2021. A traditional IRA is tax-deductible. A Roth IRA is not tax-deductible, but earnings on your investments grow tax-free.

3. If you have children, boost your savings in a 529 college savings account (like a Roth IRA), the interest will grow tax free.

4. Contribute to your FSA. Fund your flexible spending account (FSA) Contributions are tax-free up to $2,750. You’ll have to use the money during the calendar year for medical and dental expenses, but you can also use it for related everyday items such as bandages, pregnancy test kits, breast pumps and acupuncture for yourself and your family.

5. Use Dependent Care Flexible Spending Accounts (DCFSAs) —if your employer offers it. $10,500 of your pay can be contributed into a Dependent Care FSA account, tax-free. Before- and after-school care, day care, preschool and day camps are expenses it can be used for, elder care may be included, too.

6. Maximize Health Savings Accounts (HSAs)- Contributions to HSAs are tax-free up to $7,200 for 2021, and if you're 55 or older an extra $1,000. This also must be used for qualifying medical and dental expenses.

Keep an eye on your investment portfolio. Broadly speaking, investments generate income in two ways, and each is treated differently for tax purposes: Capital gains & dividends. Capital gains are an increase in the price of an asset and dividends are a distribution of money received during the year, and it’s usually subject to taxes for the tax year in which it was received.

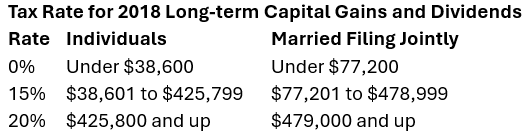

• Take advantage of lower long-term capital gains rates- Investment income is taxed differently from wage income, and that may be especially evident in the way that capital gains are treated. The IRS taxes long-term capital gains at 15 percent, 20 percent and 0 percent, depending on your income. Sometimes selling an asset in the year that your income is lower, will reduce the amount you’ll pay. Installment sales are excellent for helping keep your rate to a minimum. Timing is everything! These long-term capital gain rates are typically lower than what you’ll pay on short-term capital gains, which are taxable at the ordinary income rate. But if you hold your investment for more than a year —you’ll be able to take advantage of the long-term rates, which are likely to be significantly lower.

• Tax-loss harvesting is another way to reduce or eliminate your taxable capital gains. IRS allows you to write off realized investment losses against your gains, so you’ll owe tax only on your net capital gain. You can offset your capital gains with capital losses — up to a net $3,000 loss in any tax year. If your net losses are bigger than that, you’ll have to carry them.

Buy or sell your home or improve your home’s energy efficiency

• You can qualify to exclude the capital gain from the sale of your main home, but you must live in it for 2 years. You may exclude up to $250,000 (or $500,000 if you are married filing joint.) Mortgage interest and property tax deduction- You mush itemize your deductions instead of taking the standard deduction.

• Points- If you buy discount points, when you purchase your home, which are essentially prepaid interest. Just like home mortgage interest, these points can be deducted if you itemize your taxes. Sometimes these are called Home Origination Fees. Sellers can deduct certain closing costs- such as real estate commissions, legal fees, transfer taxes, title policy fees, and deed recording fees to lower the profit and lower the potential taxes owed.

• Home office deduction If you work from home for your own business you can get a tax deduction based on the square footage of your home office $5 per square foot for up to 300 square feet of office space, or a percentage of actual costs.

• Certain home upgrades- It’s possible to deduct some environmentally friendly upgrades to your home, such as solar panels. Up to 22% of the cost can be claimed as a credit.

2018 Tax Reform (Summary of Tax Cuts & Jobs Act)

1. Standard Deduction-

a. MFJ- 13k to 24K

b. S- 6.5K to 12K

c. HOH- $9.3 K to $18K

d. Extra for Blind or 65<

i. $1550 more per person

ii. $1250 more per person if married

2. Personal Exemption is going away (was $4150)

3. Child Tax Credit-

a. Doubles- $1000 to $2000

b. Phase out incomes increase

i. Was $110,000 MFJ to $400,000

ii. Was $75K MFJ to $200,000

4. Dependent credit- Each non- child dependent $500 credit (No exemptions)

5. Itemized deductions cutback

a. Job related moving expenses going away- only military

b. Misc 2% Deductions going away

i. No EE business expense

ii. No Brokerage or IRA fees

iii. No Tax Prep Fees

c. No Casualty or Theft Losses- Except presidentially declared disaster areas.

d. A cap of $10,000 for state and local taxes

e. Mortgage interest cap on loans up to $750K (Was $1 Mil)

6. Increase in AMT threshold- Meaning fewer middle class taxpayers will be subject to AMT Tax

a. MFJ- $109,400 to $1mill

b. S- $70,300 to $500K

7. Lifetime estate and gift tax

a. Exemption doubled from $5.5 Mil to $11Mil

b. 40% rate stays the same.

c. Annual Gift tax exclusion $15K

d. 35% rate on Annual Gift tax exceeding exclusion

8. Health Insurance Penalty- No more! Effective 01/01/2018

9. Tax Rate Changes – Rates lowered

a. Maximum individual From 39.6% to 37%

b. Shift of eligible brackets

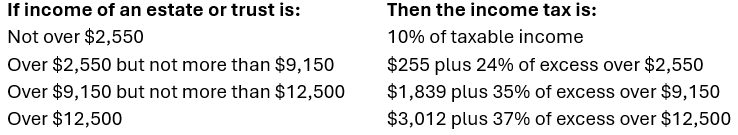

10. Tax Rates- Trusts & Estates

11. Kiddie Tax

a. Children’s unearned income will be taxed at trusts & estate rates, instead of parents marginal tax rates, which is current method.

12. College Savings Plans 529 Distributions up to $10,000 per student will be allowed to pay tuition for elementary & secondary education.

13. Capital Gains & Dividends

Business:

14. Corporate Tax Rates

a. From 35% top rate to flat 21% rate

b. No Longer AMT for Corporations

15. Small Business Benefit- Qualified Business Deduction

a. QBID- 20% deduction from net income Sole props, LLC, partners, S Corps, and Rental activity

b. Phase outs

c. Professional service fields- Phase out limits- $157,500 S

and $315,000 MFJ

16. Business Losses on Individual Returns

a. Thresh olds $250,000 S and $500,000 MFJ

b. Excess may carry forward

17. 100% Bonus Depreciation for assets purchased after Sept 27, 2017

18. New Credit for Businesses that provide Paid Family or Medical Leave.

a. 12.5% Credit

b. Increase credit for employers that pay 50%< wages during leave.

c. Limited deduction for interest

19. Limited deduction for interest on Business Debt

a. Interest write-off capped at 30% taxable income

b. Disallowed interest will carry forward

c. Firms with gross receipts of $25 mill or less, real estate co & Public utilities are exempt.

20. Other Disappearing Business Deductions:

a. Business Entertainment

b. Country club dues

c. Sexual harassment settlement payments

d. Local lobbying expenses

e. ER write-off for fringe benefits related to cost of transportation

One change in the Tax Cuts and Jobs Act is the limitation of state and local tax (SALT) deductions to $10,000. For individuals in certain localities, there’s a chance that some of the SALT they pay will not be deductible. Certain high-tax states reacted with legislation that would have effectively made state taxes a charitable donation. For instance, a taxpayer could make a donation to the state and receive a tax credit in exchange.

The IRS responded by issuing proposed regulations on Aug. 23, 2018, which effectively nullified any such action taken by the states. These proposed regulations would require that the charitable deduction be reduced by any state tax credit granted as a result of a donation. For example, if a state granted a 90 percent tax credit on contributions to the state, then only 10 percent of the donation would be deductible; a 100 percent credit would negate any charitable deduction.

There is an exception to this proposed rule. If the tax credit is 15 percent or less of the donation, the taxpayer would not be required to reduce their deduction. However, a 15 percent credit would probably not be enough incentive for the majority of taxpayers to make a state donation.

While the discussion above specifically addresses a donation to the state, the proposed regulations were broadly written to include a donation to any entity where a state tax credit is expected in excess of 15 percent of the donation.

On Oct. 3, 2018, the Internal Revenue Service issued guidance related to business expense deduction for meals and entertainment following law changes in the Tax Cuts and Jobs Act(TCJA).

The 2017 TCJA eliminated the deduction for any expenses related to activities generally considered entertainment, amusement or recreation.

Taxpayers may continue to deduct 50 percent of the cost of business meals if the taxpayer (or an employee of the taxpayer) is present and the food or beverages are not considered lavish or extravagant. The meals may be provided to a current or potential business customer, client, consultant or similar business contact.

Food and beverages that are provided during entertainment events will not be considered entertainment if purchased separately from the event.

Prior to 2018, a business could deduct up to 50 percent of entertainment expenses directly related to the active conduct of a trade or business or, if incurred immediately before or after a bona fide business discussion, associated with the active conduct of a trade or business.

The Department of the Treasury and the IRS expect to publish proposed regulations clarifying when business meal expenses are deductible and what constitutes entertainment. Until the proposed regulations are effective, taxpayers can rely on guidance in Notice 2018-76.

Updates on the implementation of the TCJA can be found on the Tax Reform page of

IRS.gov.

Call 503-399-1040 for expert tax and business advice from our team in Salem, OR.

Contact Information

Phone: 503-399-1040

Email: wilma@westsalemtax.com

Business Hours:

- Mon - Wed

- -

- Thu - Sun

- Closed

Mon - Wed: 9:00 AM - 2:00 PM

Thurs - Sun: We Work Remotely

As we get closer to tax season our hours will update.